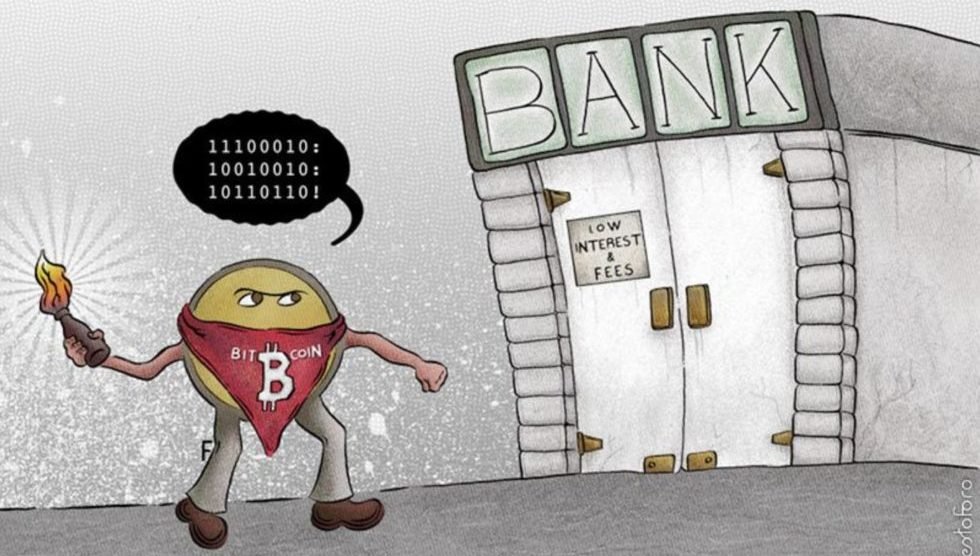

While Bitcoin is becoming more and more popular around the world, the leaders of major financial institutions - as well as those of central banks - have often been led in recent months to give their point of view on the emergence of cryptocurrencies.

If the positions are diverse, they sometimes seem to reflect a certain anxiety among the heads of these institutions.

On the side of commercial banks, Herman Gref, president of Sberbank, does not say he is opposed to the legalization of cryptocurrencies, while the Russian government seems yet openly hostile; Ulrich Stephan of Deutsche Bank warns investors about the risks of Bitcoin; Mark Haefele, Investment Director of UBS Bank, says his institution does not intend to turn to Bitcoin.

And on the side of central banks, it is possible to evoke the position of the Swiss National Bank, which seems worried about the emergence of digital currencies, or that of Mario Draghi, President of the ECB, who explained that doubted, for the moment, the real impact of Bitcoin on the economy.

Interdire les crypto-monnaies, une mauvaise idée pour la Russie ?

Herman Gref SberbankPour Herman Gref, président de la Sberbank, “les monnaies virtuelles constituent le produit naturel de la technologie blockchain. On pourrait les interdire, mais l’on pourrait également les accepter. Les institutions ont tendance à expliquer aux gens qu’ils devraient se tenir à l’écart de ces monnaies. Mais celles-ci sont bien là, c’est un fait indéniable.”

D’après Russia Today, l’homme aurait ainsi conseillé “de ne pas interdire les crypto-monnaies.” Le média russe a ajouté ceci : “Le banquier a indiqué que la technologie blockchain constituait une opportunité immense pour les entreprises, même les plus petites.”

Il convient de préciser que la Sberbank, que dirige Herman Gref, est détenue par l’État. Il s’agit de la plus grande banque d’Europe orientale, mais également du troisième établissement bancaire européen, en termes de capitalisation.

Il y a quelques semaines, une étude étude menée par la Russian Association of Blockchain and Cryptocurrency avait montré que les ICOs auraient faire perdre plus de 250 millions de dollars à l’économie russe – certains entrepreneurs locaux s’installant à l’étranger afin de conduire de telles levées de fonds.

"Individuals should avoid Bitcoin"

Ulrich Stephan

Although he seems far from pronouncing on a ban on Bitcoin, Ulrich Stephan, Deutsche Bank's Global Chief Investment Officer Private and Commercial Clients, said he "would not recommend that to a casual investor."

The man calls on individuals not to bet on crypto-currencies - because of their volatility, but also the lack of regulation that surrounds them.

Axel WeberThese comments echo those issued by Axel Weber, chairman of the supervisory board of Swiss bank UBS, who said he was "extremely cautious about Bitcoin". However, he explained that he was, like many of his counterparts, in favor of blockchain technology.

Mark Haefele of UBSSi these leaders simply point fingers the risk of capital loss associated with Bitcoin, others are much more severe with respect to cryptocurrency. This is the case of Mark Haefele, Investment Director of UBS Bank, who spoke about the potential role of Bitcoin in the financing of terrorism:

"All that would be the appearance of a terrorist act on American soil, financed by Bitcoins. The American regulator would then take the problem more seriously, and take action. It is a risk, certainly unquantifiable, that hangs over Bitcoin, "he said recently to the Bloomberg group.

Outstanding issues on the side of central banks

"Central banks are very active right now on that [the cryptocurrency issue]," said Thomas Jordan, president of the Central Bank of Switzerland (Swiss National Bank). "It is important to explain that this is not a question of technology, but who has access to the money from the central bank and in what form. Many questions remain unresolved, "he warned.

Mario Draghi BCEP for Mario Draghi, director of the European Central Bank, "this risk is rather limited. Therefore, it is not, for now, an element likely to pose a threat to the central banks. "He still wanted to evoke the existence of" accumulation of risks ", that could be a problem in a few years.

A few days ago, the BNP Paribas banking group, based in France, published a report on the future of Bitcoin. This is in any case what the newspaper The Telegraph asserts - information to be taken in the conditional, in so far as it was impossible for us to obtain a copy of the report which is mentioned there.

The group believes that the risks related to Bitcoin are important especially because it has no opportunity to act as a "lender of last resort" as central banks can do in the event of a financial crisis.

The bank also raised the risks inherent in the deflationary nature of Bitcoin, which encourages people to store value rather than using it to consume.

Finally, it would call for the establishment of a sound regulatory framework around the use of cryptocurrencies, which raise concerns about money laundering, financial stability, tax evasion and to crime. "

Digitized national currencies?

Some central banks recently said they wanted to create their own digital currency.

It will not be, and this is all logical, currencies similar to Bitcoin - whose most notable feature is found in its decentralized nature - but currencies issued and supported by the government, which will probably constitute only a dematerialized version of the official currency.

They will not replace fiduciary money, but rather constitute a form of payment complementary to it.

This is the case in Russia, according to an announcement by Vladimir Putin of Uruguay, who has already set up an "e-peso", intended to limit the (expensive) production of fiat money, or even Sweden, who are currently working on the creation of an "e-krona" ("e-crown") ".

For the Bank of Sweden, it "will have the potential to counter some of the problems that may arise in the future in payment markets."

Commentaires

Enregistrer un commentaire