The price of Bitcoin has reached a new ATH, and continues to climb at the time of writing this article. Bitcoin is currently estimated at more than $ 9600, and all eyes are on the symbolic threshold of $ 10,000. To the moon?

Bitcoin: an incomparable growth

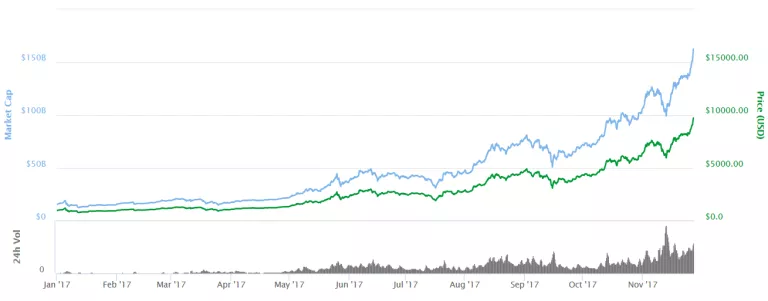

2017 has been an impressive year for Bitcoin. Priced at just over $ 900 on January 1, the price has been multiplied by 10 over the months. Bitcoin is now capitalized at more than 160 billion dollars, 10 billion less than the capitalization of Mastercard (171 billion dollars). During the last 24 hours, a volume of almost 6 billion dollars has been exchanged.

It now seems very likely that the value of bitcoin will reach $ 10,000 by the end of the year, confirming Ronnie Moas' prophecy a few months in advance.

Trace Mayer - one of Kraken's main investors, BitPay and Armory - also noted that Bitcoin was now the 30th largest currency in the world. Cryptocurrency has indeed exceeded certain fiduciary currencies, such as the Singapore dollar or the United Arab Emirates dirham.

Institutional investment is underway

It seems that more and more institutional investors are setting their sights on Bitcoin. Since the announcement of the CME ringing the arrival of futures on Bitcoin, the first cryptocurrency market attracts more and more investors.

For example, JPMorgan recently announced that it is studying to offer their clients these famous futures contracts. Thus, this sudden surge in price could very well be attributed to the arrival of large investors in the market.

About institutional investors, Shinhan, South Korea's second largest commercial bank, has begun a test phase to offer its customers wallets and "safe-deposit boxes" for Bitcoin.

"Shinhan is currently testing a Bitcoin virtual safe where private keys and bitcoin addresses are managed and issued by the bank. The bank plans to provide the safe system for free, and introduce a tax on withdrawals. A Shinhan representative, interviewed by Naver

Pour l’instant, le marché des cryptomonnaies n’est pas régulé en Corée du Sud, mais l’implication de Shinhan va probablement changer la donne. Plus de régulation mène à plus d’investissement. Plus d’investissement mène à un prix toujours croissant.

Une correction est peut-être à attendre sur le prix, même si l’histoire de Bitcoin nous a déjà prouvé que nos attentes ne sont pas toujours réalité. Bitcoin pourrait tout à fait poursuivre sa progression vers de nouveaux sommets, et les investisseurs attendre un dip qui ne viendrait jamais.

Commentaires

Enregistrer un commentaire