Mike Novogratz, a millionaire investor and former manager at Fortress Investment Group, believes that Ether, the currency used on the Ethereum network, may soon reach new historical records.

"ETH seems ready to reach new heights. Many positive news on the horizon, "he said.

South Korea seizes Ethereum

In recent weeks, the daily trading volume of Ether has risen sharply. This increase seems partly driven by South Korean exchange platforms.

It should be remembered that the price and demand for Ether had decreased in the country for a short time, following the ban on ICOs (fund-raising in cryptocurrencies) pronounced by the government.

Since then, the South Korean market seems to have regained color, and now accounts for 33% of the Ethereum market. The main platforms concerned are Bithumb and Coinone, which alone account for almost a quarter of this market:

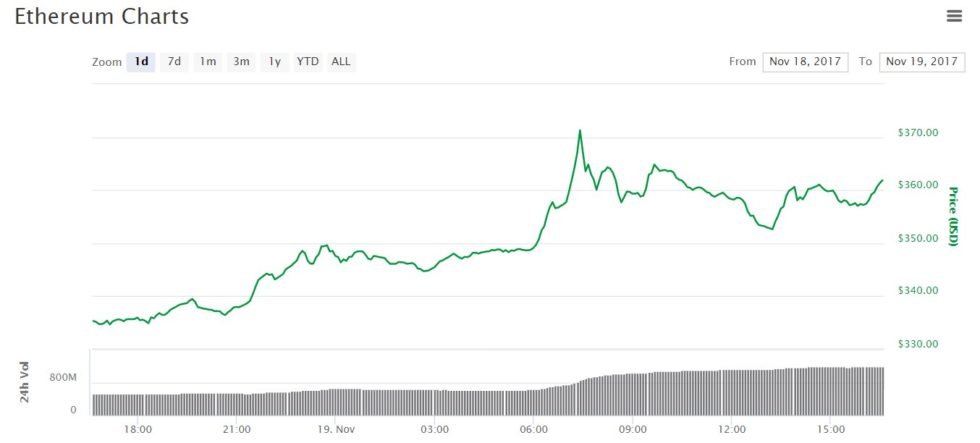

Over a 24-hour period, the price of Ether increased by almost 8% from $ 335 to $ 362.

Contrary to the forecasts of many analysts, the Byzantium update, which had been deployed in mid-October, did not lead to an increase in the price of Ether - the latter having found it difficult to iron over the 300 dollars.

Henceforth, the market seems optimistic about the increased stability of the Ethereum network since the Byzantium hard fork, and we are witnessing significant progress in scaling solutions (its capacity to support the increase in the number of daily transactions) - both on the Ethereum blockchain (on-chain) and off-chain - with systems like Plasma, the "sharding" or Casper.

Vitalik buterinVitalik Buterin, the co-founder of Ethereum, revealed that many investors had asked him, wrongly, if the Ethereum Foundation would propose new ICOs for the sharding and Casper.

"I just spoke to a new person asking me if Casper and the sharding will consist of a new currency, and if there will be an ICO then. It drives me crazy, "said Mr. Buterin.

The young developer had already pointed out some open-source scaling projects that launched ICOs, especially those that did not need crypto-tokens to function.

Could the arrival of institutional investors in Bitcoin also favor Ether?

C: \ Users \ David \ Desktop \ My projects \ Crypto-france \ 267-coinbase \ brian-armstrong.jpgBrian Armstrong, the CEO of Coinbase, revealed this week that $ 10 billion of institutional funds were waiting to be dumped in Bitcoin - which prompted him to launch the Coinbase Custody service in 2018.

"According to some estimates, there is currently $ 10 billion in institutional money wisely waiting to be invested in digital currencies," Armstrong said.

But some institutional investors should go ahead. The CME Group has announced the launch of a Bitcoin futures contract for the month of December, while Man Group, a $ 95 billion investment fund, plans to invest soon in Bitcoin.

As tens of billions of dollars of institutional funds move from the "traditional" financial sector to Bitcoin, Ether, as the second largest cryptocurrency in the market, may benefit from this growing interest in digital currencies.

Great read! Follow daily crypto news

RépondreSupprimerThank you for sharing this information.

RépondreSupprimerCoinOrbisCap is the best user-friendly financial app who take digital currency seriously. Gives you quick access to crypto prices, market cap, coin chart, crypto news on over 1500 currencies.

Download here for FREE!