In South Korea, several large financial institutions, but also some service providers, have decided to integrate Bitcoin into their infrastructure, which should make it easier for people to switch to cryptocurrency.

Vendor vendor to add support for Bitcoin

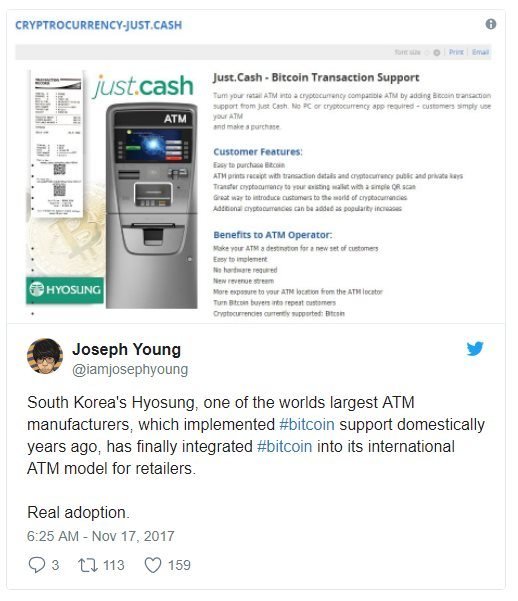

As we mentioned in this article, the Hyosung Group has announced that it will allow individuals to buy Bitcoin through its distributors.

It relies on just.cash technology, thanks to which all existing distributors will offer the opportunity to buy digital currency.

Thus, for the tens of thousands of businesses that have Hyosung distributors, a simple software update will directly integrate Bitcoin, without having to install new equipment.

Bitcoin will be integrated with its 20,000 distributors abroad - the company should focus on the US market.

The integration of Bitcoin in the distributors proposed by Hyosung should allow ordinary consumers to easily buy cryptocurrencies. These distributors will not require them to undergo complex verification procedures, such as Know Your Customer (KYC) or anti-money laundering requirements, which may require several weeks of processing.

However, it should be noted that these distributors will be far from being the first to offer such a feature.

In 2013, Coinplug had already set up nearly 20,000 Bitcoin distributors in South Korean shops.

South Korean banks are interested in Bitcoin

Shinhan BankThis week, Shinhan Bank, the second largest commercial bank in South Korea, announced that it is currently conducting tests to offer its customers a Bitcoin wallet, as well as a digital currency safe service.

This will allow them to store, send and receive Bitcoins through a secure and secure banking platform.

Tony Lyu is the founder and CEO of Korbit, a major South Korean cryptocurrency trading platform. The man recently sold his company for $ 80 million to the company Nexon, specializing in the creation of video games.

In an interview with Nathaniel Poppers of the New York Times, he spoke about people in South Korea's financial sector.

He believes that an asset can succeed in the country's financial ecosystem if it manages to arouse the craze of part of the population, inclined to recommend it around it.

"Word of mouth works very well in Korea. Once some people have invested in an asset, they encourage others to do the same. There is a strong community movement around Bitcoin, "said Lyu.

The integration of Bitcoin in many South Korean institutions is expected to fuel the surge in demand for digital money in the coming months, particularly if the government decides to formally regulate and legalize its use.

Receive every morning a summary of the latest news of the last 24 hours of the cryptocurrency world. @tighilt

Commentaires

Enregistrer un commentaire