While the price of Bitcoin continues to reach new heights, 4 million corners (of the 16.7 million currently in circulation) could, according to a new study, have been lost forever.

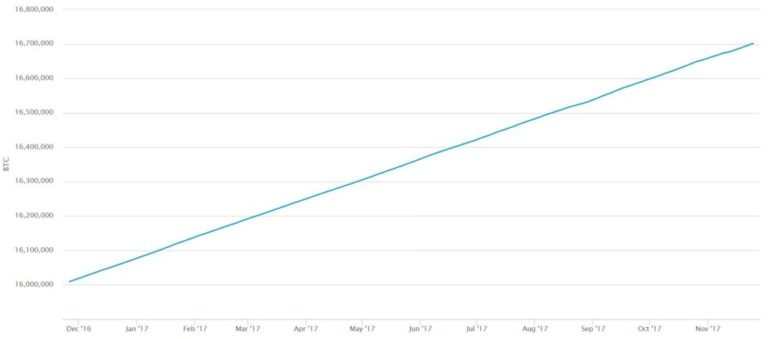

A rain of records

Bitcoin has once again reached record highs, now exceeding the $ 9700 mark (around € 8,130). Many factors could explain this increase of more than 950% since the beginning of the year.

We can notably mention the arrival of institutional investors, eager to invest in cryptocurrency.

This arrival should be facilitated by the initiative of the CME Group, which will propose next month Bitcoin futures, or that of Coinbase, which announced the launch of Coinbase Custody for 2018 - a service dedicated to institutional investors who would like to offer their clients the opportunity to invest in digital assets.

But while the prospect of the arrival of institutional financing is certainly not unrelated to the rise we are witnessing, another argument has been put forward. It concerns the number of Bitcoins that would have been lost forever - a number that would reduce the level of "real" supply of coins in circulation, and thus potentially increase the scarcity of this asset.

Nearly 4 million Bitcoins lost?

Chainalysis logo In the same way gold bars are sometimes lost at sea, or tickets can burn, Bitcoins can "disappear" forever if their original owners are no longer able to use them.

Thus, when all 21 million Bitcoins have been "mined", which will occur around the year 2140, the actual available corners should be significantly fewer.

This is indicated by a study conducted by Chainalysis, a New York company specializing in the conduct of blockchain-related analysis. According to the results of this survey, many Bitcoins are already lost forever: between 2.77 million (low estimate) and 3.79 million (high estimate).

While some observers have simply made simple assumptions about the number of Bitcoins lost, the results of the study conducted by Chainalysis are based on a detailed analysis of the blockchain bitcoin, on which all transactions are saved.

According to the company, between 17% and 23% of the number of existing Bitcoins could no longer be spent. This corresponds to a value between 22.5 and 30.8 billion euros (for a Bitcoin 8130 euros).

There are, in fact, currently 16.7 million Bitcoins in circulation - which corresponds to 79.5% of Bitcoins that will ever be created.

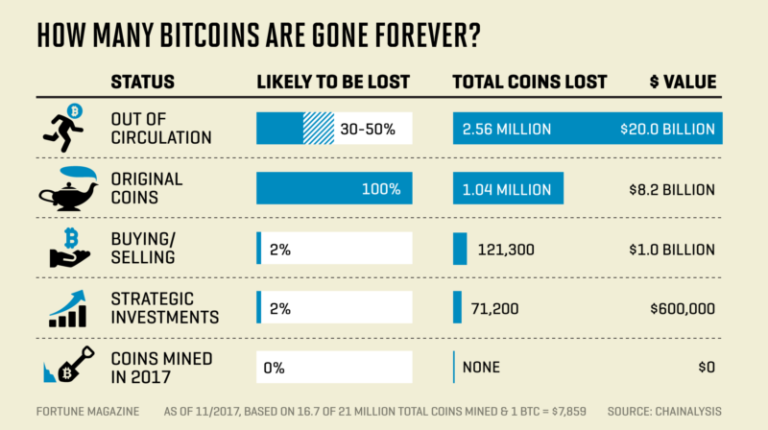

Here is an infographic presenting the results of the analysis conducted by Chainalysis:

It has chosen to "segment" the existing offer of Bitcoins, based on the age of the portfolios and the nature of the transactions. For some segments, it also used sampling methods to try to estimate the number of Bitcoins lost.

There is a nil proportion of Bitcoins lost for the "corners mined in 2017" category, as well as a small proportion for the "buying / selling" group, which corresponds to the portfolios that have recorded movements since the beginning of the year.

Similarly, the category of "strategic investments" - individuals or companies that hold Bitcoins for 1 to 2 years - accounts for only a small part of the losses.

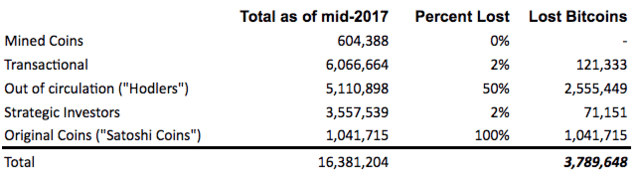

Here is the same data presented in a different form:

We can see that the majority of lost Bitcoins are linked:

to Bitcoin "out of circulation" - corners that were mined 2 to 8 years ago, and that would belong to investors presented as "hodlers"

to "original" Bitcoins (the "satoshi coins") dating from the first months of the existence of Bitcoin, which would have been lost in their entirety

Note that these figures are based only on Bitcoins that have been lost by their holders. The phenomenon of piracy has no impact on this data - since new "owners" will then control the stolen Bitcoins, which are still in circulation.

to "original" Bitcoins (the "satoshi coins") dating from the first months of the existence of Bitcoin, which would have been lost in their entirety

Note that these figures are based only on Bitcoins that have been lost by their holders. The phenomenon of piracy has no impact on this data - since new "owners" will then control the stolen Bitcoins, which are still in circulation.

Moreover, the figures presented in this table correspond to a high estimate. The low estimate leads to an estimated loss of "only" 30% in the "hodlers" - that is, 2 767 468 Bitcoins that would have evaporated.

Finally, these estimates are based on the assumption that the corners belonging to Satoshi Nakamato, the creator of Bitcoin, would be lost for good (you will find more information on this in the rest of this article).

What could be the consequences of these losses?

In the future, the number of lost Bitcoins should increase. But the speed at which they will disappear should be much lower, as their owners are now much more cautious because of the high price of Bitcoin. This is what Greg Schvey, CEO of Axoni, explained in 2014.

We can imagine that this man, who had got rid of a hard drive with 7500 bitcoins, would have taken extra precautions if the Bitcoin was worth several thousand euros.

But what are the consequences of these results on the price of Bitcoin? Bitcoin would it be more "rare" than economic agents think - or would the market have already "priced" lost corners in the current price of money?

"This is a very complex issue. On the one hand, calculations concerning the capitalization of Bitcoin do not take into account this problem [note: the 'real' capitalization of Bitcoin would indeed be lower than that displayed on sites like Coinmarketcap]. To the extent that this is a very speculative area, these capitalization calculations could be integrated into economic models taking into account the expenditures made by the portfolios, said Kim Grauer, senior economist at Chainalysis.

"Nevertheless, the market has adapted to the demand and the available supply - it is enough to focus on

exchange behavior. On the other hand, it is known that monetary policies aimed at decreasing or increasing the supply of money have an impact on interest rates. Therefore, the answer is both yes and no, "he concluded.

exchange behavior. On the other hand, it is known that monetary policies aimed at decreasing or increasing the supply of money have an impact on interest rates. Therefore, the answer is both yes and no, "he concluded.

Lost Bitcoins, and "the secret of Satoshi"

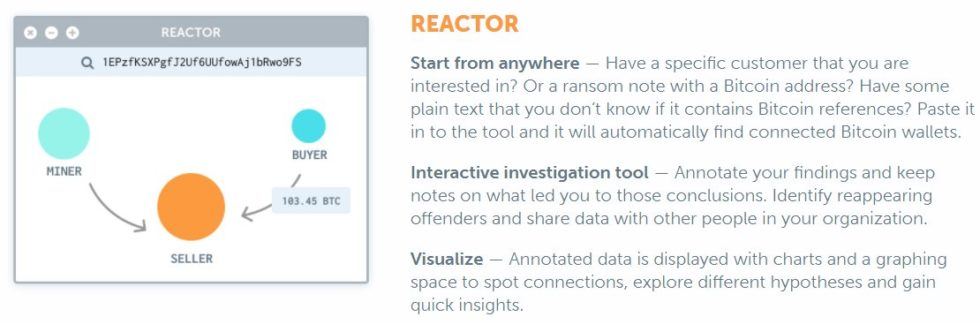

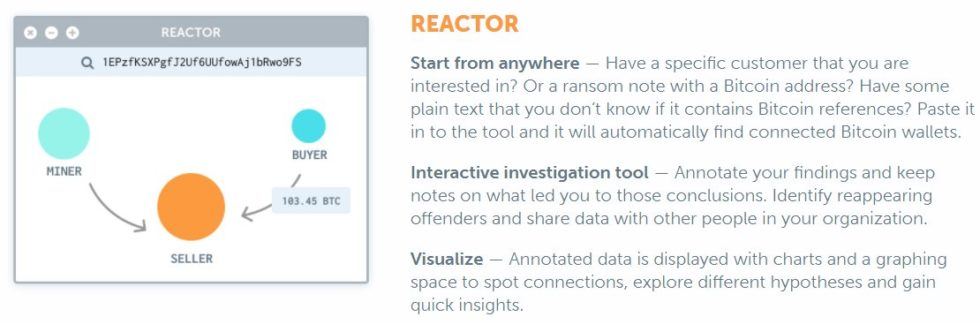

Chainalysis, whose clients include the US Internal Revenue Service and Europol, has made a name for itself in the Bitcoin ecosystem through a number of services related to blockchain technology.

Some law enforcement agencies rely on the company for detailed information on certain Bitcoin transaction flows. In particular, they may be able to gather information about a specific portfolio, or use Chainalysis' expertise to find ransom applicants.

But how did Chainalysis achieve such results?

If the methodology used by the company remained confidential, one of its spokespersons still gave some details.

Many clues would come from the "forks" of the blockchain Bitcoin, as the one who was recently at the origin of the creation of Bitcoin Cash. Indeed, such events can lead some holders of wallets, which have been inactive for several years, to conduct transactions, which offered some statistical opportunities to Chainalysis.

In particular, the company will be able to obtain data relating to the category of "hodlers" - those individuals who obtained Bitcoins when the currency was confidential, and which represent the greatest source of uncertainty. It will be able to know if these Bitcoins are lost, or only "accumulated" in the long term by their owners.

Regarding the 2% of Bitcoins that would be lost by the "transactional" portfolios, the company explained that it used "scraping" methods, browsing the web for lost corners.

She believes that such losses may have occurred as a result of shipments to wrong addresses, deaths or negligence on the part of the owners. These estimates, however, are not based on statistical extrapolations, and should be refined in the coming years.

Satoshi Nakamoto Finally, there is the question of the fate of Bitcoins held by Satoshi Nakamoto, the developer (or group of developers) behind the creation of Bitcoin.

For Chainalysis, the wallets associated with Mr Nakamoto correspond to 1 million Bitcoins (the company will provide a more specific figure by the end of the year). The model used assumes that these corners - which come from a time when it was easy to undermine dozens of Bitcoins with a simple laptop - would be lost forever. Note that this is a very hypothetical assumption: many Bitcoins could be quickly put on the market if it turns out to be incorrect.

For further

Based on our research, we have been able to find some interesting resources (in English) related to this issue:

This tutorial may allow you to find Bitcoins lost after the "crash" of your hard drive.

This article discusses the issue of death of Bitcoin holders. He provides some tips to bequeath his bitcoins to his relatives.

This company, Wallet Recovery Services, offers support services for the recovery of Bitcoins and Ethers.

This article discusses the issue of death of Bitcoin holders. He provides some tips to bequeath his bitcoins to his relatives.

This company, Wallet Recovery Services, offers support services for the recovery of Bitcoins and Ethers.

Commentaires

Enregistrer un commentaire