CME Group (NASDAQ: CME) is ready to shyly launch Bitcoin futures this year in the midst of a heated debate, unlike the position and value of the digital currency itself, as investors institutions are banking on an activity up $ 10 billion.

In late October, CME Group CEO Terry Duffy announced the launch of a Bitcoin futures contract before the beginning of 2018, in response to "growing customer interest in the cryptocurrency markets. in full evolution. "

Although it has exceeded $ 9,000 this weekend or perhaps because of its incredibly fast trajectory, Bitcoin is still the target of its critics with Jamie Dimon, CEO of JP Morgan who calls it a "scam" and some experts who are worried that its rising price has all indications of a speculative bubble. The digital currency climbed 906% during volatile trading this year, with three separate corrections of more than 25%, all of which gave way to subsequent rallies. At current prices, Bitcoin has a total market capitalization of approximately $ 162 billion.

In late October, CME Group CEO Terry Duffy announced the launch of a Bitcoin futures contract before the beginning of 2018, in response to "growing customer interest in the cryptocurrency markets. in full evolution. "

Although it has exceeded $ 9,000 this weekend or perhaps because of its incredibly fast trajectory, Bitcoin is still the target of its critics with Jamie Dimon, CEO of JP Morgan who calls it a "scam" and some experts who are worried that its rising price has all indications of a speculative bubble. The digital currency climbed 906% during volatile trading this year, with three separate corrections of more than 25%, all of which gave way to subsequent rallies. At current prices, Bitcoin has a total market capitalization of approximately $ 162 billion.

CME's Duffy noted that his intention was not to control market volatility, but to manage risk by providing a way to bypass cryptocurrency.

"I'm not trying to curb the volatility of Bitcoin. But what I want to do is create a place for others to take action on this risk, "Duffy told CNBC in an interview in mid-November.

"Today, you can not bypass Bitcoin. So there is only one way to do it. You buy it or sell it to someone else. So you create a two-sided market, I think it's still much more efficient, "he said.

Short positions are generally seen as a way of balancing market forces, allowing investors to bet on rises or falls. To understand the short position, an investor simply "borrows" the asset at a given price and sells it for money. If the price goes down, they buy back the asset and return it, pocketing the difference. Short positions also allow trading companies to adopt neutral strategies in the market, giving them the opportunity to end each trading day without losses.

"I'm not trying to curb the volatility of Bitcoin. But what I want to do is create a place for others to take action on this risk, "Duffy told CNBC in an interview in mid-November.

"Today, you can not bypass Bitcoin. So there is only one way to do it. You buy it or sell it to someone else. So you create a two-sided market, I think it's still much more efficient, "he said.

Short positions are generally seen as a way of balancing market forces, allowing investors to bet on rises or falls. To understand the short position, an investor simply "borrows" the asset at a given price and sells it for money. If the price goes down, they buy back the asset and return it, pocketing the difference. Short positions also allow trading companies to adopt neutral strategies in the market, giving them the opportunity to end each trading day without losses.

In fact, the Swiss Vontobel AG (SIX: VONN) and Leonteq Securities AG beat CME with their products launched on November 17 that allow investors to take advantage of the fall of Bitcoin.

Leonteq's director of public solutions, Manuel Durr, told Bloomberg that the initial reactions were "extremely positive. Customers very much appreciate the opportunity to choose between a long-term or short-term investment in Bitcoin. "

In any event, Duffy admitted that the trading of their new Bitcoin futures contracts would be interrupted for one hour in the event of a 20% up or down movement, like individual circuit breakers or the upper limit of the SEC, mechanism to control sales driven by panic or any type of excessive volatility, and added that investors will have to put up about 30% collateral as a protection against losses.

However, Thomas Peterffy, president and founder of Interactive Brokers, recently argued that "it is impossible to obtain such a product in a reasonable way."

Leonteq's director of public solutions, Manuel Durr, told Bloomberg that the initial reactions were "extremely positive. Customers very much appreciate the opportunity to choose between a long-term or short-term investment in Bitcoin. "

In any event, Duffy admitted that the trading of their new Bitcoin futures contracts would be interrupted for one hour in the event of a 20% up or down movement, like individual circuit breakers or the upper limit of the SEC, mechanism to control sales driven by panic or any type of excessive volatility, and added that investors will have to put up about 30% collateral as a protection against losses.

However, Thomas Peterffy, president and founder of Interactive Brokers, recently argued that "it is impossible to obtain such a product in a reasonable way."

"While the buyer (long position) of a cryptocurrency futures contract or call option could be required to put 100% of the value to ensure security, the determination of the margin requirement for the (short positions) is impossible, "he argues in a full-page ad in the November 15 edition of the Wall Street Journal, which is an excerpt from his letter to the Commodity Futures Trading Commission.

"Unless the risk of clearing the cryptocurrency is isolated and separated from other products, a catastrophe in the cryptocurrency market that destabilizes a clearing organization will destabilize the real economy, the main stock market indices and material markets. first, "he says.

In an interview with CNBC, Peterffy insisted that he was "not against the Bitcoin trade" and that cryptocurrencies were a "good idea".

"What I am opposed to is to link Bitcoin and other crypto-currencies with federal regulations to the real economy, which would happen if we adopted Bitcoin and other products within the same medium. of exchange, "he explained.

Peterffy points to the huge price swings in Bitcoin and suggested that the futures limit does not allow sellers to hedge their investment. "It could bring down the entire economy," he speculated.

"Unless the risk of clearing the cryptocurrency is isolated and separated from other products, a catastrophe in the cryptocurrency market that destabilizes a clearing organization will destabilize the real economy, the main stock market indices and material markets. first, "he says.

In an interview with CNBC, Peterffy insisted that he was "not against the Bitcoin trade" and that cryptocurrencies were a "good idea".

"What I am opposed to is to link Bitcoin and other crypto-currencies with federal regulations to the real economy, which would happen if we adopted Bitcoin and other products within the same medium. of exchange, "he explained.

Peterffy points to the huge price swings in Bitcoin and suggested that the futures limit does not allow sellers to hedge their investment. "It could bring down the entire economy," he speculated.

But William Mallers, Jr. described these findings as "exaggerated". The co-founder of First American Discount Corporation, the third largest discount broker prior to its 2001 sale to Man Financial, argued that CME's compensation privilege required significant capital and sufficient trading if the threshold capital level of a Member fell below the threshold necessary for compensation.

"CME did his homework on Bitcoin; he knows the evolution of Bitcoin's volatile prices and has the experience and the controls necessary to compensate for Bitcoin futures, "he said in an opinion piece for CoinDesk.

Bitcoin would it be accepted?

Whether you're a fan or a skeptic, CME's forthcoming CME Bitcoin launch is another step in the direction of acceptance, on the heels of its competitor CBOE Holdings (NASDAQ: CBOE), which announced in August launching their own Bitcoin futures, also by the end of the year.

"CME did his homework on Bitcoin; he knows the evolution of Bitcoin's volatile prices and has the experience and the controls necessary to compensate for Bitcoin futures, "he said in an opinion piece for CoinDesk.

Bitcoin would it be accepted?

Whether you're a fan or a skeptic, CME's forthcoming CME Bitcoin launch is another step in the direction of acceptance, on the heels of its competitor CBOE Holdings (NASDAQ: CBOE), which announced in August launching their own Bitcoin futures, also by the end of the year.

The main challenge for market makers has been to involve institutional investors in digital assets. With this in mind, Coinbase recently announced its intention to launch a company called Coinbase Custody to help institutional investors store their digital assets safely.

"When we talk to these institutions, they tell us that the first thing that prevents them from starting is the existence of a digital asset custodian that they could trust to store customers' funds safely," he wrote. Brian Armstrong, CEO and co-founder of Coinbase.

"According to some estimates, $ 10 billion in institutional money is set aside waiting to invest in digital currency today," Armstrong said.

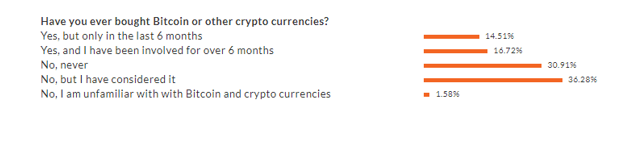

So far, the institutional interest in Bitcoin investments seems to be divided. Of 317 institutional traders surveyed by Triad Securities and DataTrek Research between November 6 and 13, about 31% admitted to investing in Bitcoin or other cryptocurrencies, and half of them in the last six months , suggesting that this year's rally has generated a lot of interest in the world of professional investing. However, 31% of them said they were opposed to trying their luck with digital assets. Yet 36% admitted they had considered the option without stepping into the water, suggesting that a significant number of investors

"When we talk to these institutions, they tell us that the first thing that prevents them from starting is the existence of a digital asset custodian that they could trust to store customers' funds safely," he wrote. Brian Armstrong, CEO and co-founder of Coinbase.

"According to some estimates, $ 10 billion in institutional money is set aside waiting to invest in digital currency today," Armstrong said.

So far, the institutional interest in Bitcoin investments seems to be divided. Of 317 institutional traders surveyed by Triad Securities and DataTrek Research between November 6 and 13, about 31% admitted to investing in Bitcoin or other cryptocurrencies, and half of them in the last six months , suggesting that this year's rally has generated a lot of interest in the world of professional investing. However, 31% of them said they were opposed to trying their luck with digital assets. Yet 36% admitted they had considered the option without stepping into the water, suggesting that a significant number of investors

According to the survey, institutional investors did not have a majority opinion on the future of Bitcoin, with 39% insisting that it is a bubble that should explode while 27% expect continuous gains at a more gradual pace. 16% bet that the value will double in the next six months while 17% admit they do not know or have no opinion.

The introduction of Bitcoin futures could also pave the way for the next expansion of investment vehicles into digital assets: the creation of Bitcoin Exchange Traded Funds (ETFs). Bitcoin ETFs could further broaden the range for institutional investors who are generally prohibited from purchasing unregulated securities.

The idea is that the existence of Bitcoin futures would make obtaining an approval for an ETF easier. The Securities and Exchange Commission (SEC) rejected an application in March due to supervisory issues. "The Commission believes that important markets for Bitcoin are not regulated," the SEC said in its submission.

All this could change with the new CBOE and GCE projects as both institutions are closely monitored by Washington regulators. Operators are banking on SEC approval for Bitcoin ETFs within six to twelve months.

Meanwhile, the heated debate over whether Bitcoin and cryptocurrencies are "worthless" assets in a bubble, will likely continue to rage. The speculative buzz is that the influx of institutional investors via parallel investment opportunities such as future Bitcoin futures could push the underlying asset above $ 10,000 this year (a goal that is close to the reality as last week) as the hype continues to attract new investors. 906% gains so far this year.

Is it too late to participate or is it just the beginning? Time will tell us.

The idea is that the existence of Bitcoin futures would make obtaining an approval for an ETF easier. The Securities and Exchange Commission (SEC) rejected an application in March due to supervisory issues. "The Commission believes that important markets for Bitcoin are not regulated," the SEC said in its submission.

All this could change with the new CBOE and GCE projects as both institutions are closely monitored by Washington regulators. Operators are banking on SEC approval for Bitcoin ETFs within six to twelve months.

Meanwhile, the heated debate over whether Bitcoin and cryptocurrencies are "worthless" assets in a bubble, will likely continue to rage. The speculative buzz is that the influx of institutional investors via parallel investment opportunities such as future Bitcoin futures could push the underlying asset above $ 10,000 this year (a goal that is close to the reality as last week) as the hype continues to attract new investors. 906% gains so far this year.

Is it too late to participate or is it just the beginning? Time will tell us.

Commentaires

Enregistrer un commentaire